It is very important to know if your compensation or personal compensation will be taxable and how this can affect the total amount of compensation you receive. You also want to avoid having to pay fines for unreported taxable income. Are personal injury settlements taxable?

In most cases, there is no tax due on personal injury compensation because the Internal Revenue Service (IRS) does not consider this type of income to be payable. However, there are important exceptions.

It is very important to know if your compensation or personal compensation will be taxable and how this can affect the total amount of compensation you receive. You also want to avoid having to pay fines for unreported taxable income.

When compensation for personal injury is NOT taxed

Generally, proceeds from a settlement agreement or a jury decision are not subject to state or federal income tax. However, this general tax exemption applies only to damages you receive as reimbursement of costs incurred as a result of personal injury or physical illness. In addition, new, stricter restrictions have been introduced on what damages are excluded from federal taxes (information on these new restrictions is discussed below).

The rationale for the general exclusion of compensation from taxes is that the money you receive as a reimbursement of these damages and losses is intended to compensate you for all or, as a result, to pay for the damages you had to endure as a result of the accident. For example, if you have $ 10,000 for medical expenses resulting from treatment received after an accident and you receive $ 10,000 for damage to your health or a jury award, then you basically get a refund and you don’t enjoy the financial treat.

Exceptions to the non-taxable compensation

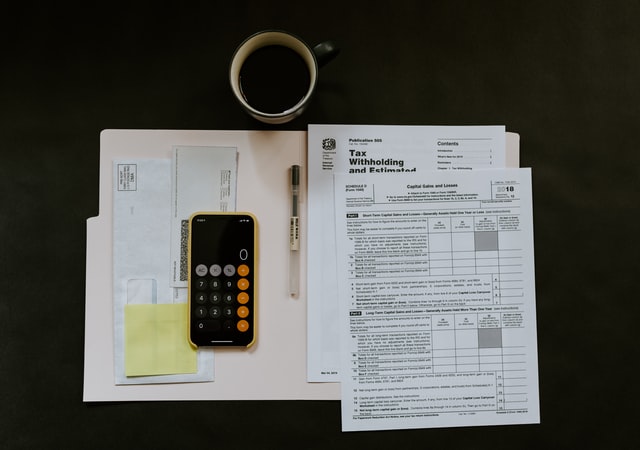

There are exceptions to when compensation for personal injury is taxable. For example, if you include medical expenses related to damage as part of your tax deduction in your tax return for the previous year, the portion of the reward that was used to reimburse these expenses may be taxable. The reasons why the IRS justifies that it is unfair to receive tax deductions for medical expenses that have been paid for in the settlement. In addition, regardless of whether you receive remuneration from your employer or whether these remuneration is included in the settlement award, you must pay income tax on this part.

Many injured people have to pay medical bills while awaiting settlement. Sometimes it takes more than a year to settle the claim, so you can try to maximize your tax refund by specifying these responsibilities, especially if you have accumulated other accident-related expenses. However, if you have not deducted these cost items before, you do not need to include them in your taxable income.

If your damages result from a breach of contract, they will be taxable if the breach of contract is the basis of your lawsuit. In addition, criminal damages and interest on the judgment are taxable.